- Navigation

- Home

- Who We Are

- » Our History

- » Our Approach

- » Our Advisors

- How We Help

- » Financial Planning

- » Retirement Income Planning

- » Investment Management

- » Fiduciary Services

- » Employer Retirement Plans

- » Risk Management

- » Tax Management

- » Estate & Trust Planning

- News

- Resources

- » Client Login

- » FAQ

- » Downloads

- Contact

- Form CRS

News

On October 30, 2023, we hosted an informational webinar on the latest tax issues, year-end planning opportunities, an overview of recent legislation, and details on how the SECURE Act 2.0 will change retirement. Click below to watch the full recording.

With the 2024 tax year right around the corner, there's good news coming from the IRS. According to a recent announcement from the tax agency (Notice 2023-75), there will be increases to retirement plan contributions next year due to inflation adjustments. Here's a rundown of some of the changes: Contributions to 401(k) and 403(b) Plans. Taxpayers will be able to contribute up to $23,000 in 2024, ...

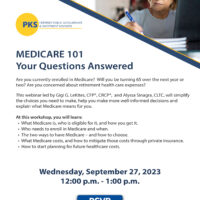

On September 27, 2023, we hosted an informational webinar about Medicare. Watch this video hear insights on topics such as: What Medicare is, who is eligible for it, and how you get it. The two ways to have Medicare - and how to choose. What Medicare costs, and how to mitigate those costs through private insurance. How to start planning for future healthcare costs. Click below to watch the...

The Setting Every Community Up for Retirement Enhancement (SECURE) Act brought numerous changes to the retirement and estate planning landscape in late 2019. Congress followed up with the SECURE 2.0 Act in late 2022. This law introduced some additional taxpayer-friendly changes, including an increase in the limits for retirement account catch-up contributions for individuals who are age 50 or ...

PKS Investment Advisors LLC is pleased to announce Kyle M. Banks has joined the firm as an Associate Advisor in our Salisbury, MD office. Kyle brings a strong skill set consisting of client service and communication, and trade recommendations and execution from his previous work experience at the Baltimore-based global financial services firm Morgan Stanley where he served as a Finance Director ...

For married people with large estates, the Tax Cuts and Jobs Act (TCJA) brings welcome relief from federal estate and gift taxes, as well as the generation-skipping transfer (GST) tax. Here's what you need to know and how to take advantage of the favorable changes. Estate and Gift Tax Basics The TCJA sets the unified federal estate and gift tax exemption at $12.92 million per person for 2023 (up ...

It's important to create an estate plan so your loved ones will know your wishes regarding your wealth and other issues. The first step is to work with your advisors to draft and sign a will, health care directives, powers of attorney and, potentially, trust documents. But there's another critical task. You'll need to find places to store estate-planning documents that are both safe and easily ...

Many retirees have seen their Social Security benefits increase in 2023 due to a cost-of-living adjustment that was higher than in past years. Further increases are expected for 2024. While more benefits are welcome, they could mean more income taxes on those benefits for some recipients. The Social Security Administration (SSA) estimates that more than half of recipient families owe federal ...

Last August, the highly respected Conference Board, which compiles the Leading Economic Index, believed the U.S. economy would not expand in the third quarter of 2022 and “could tip into a short but mild recession by the end of the year or early 2023.” The Conference Board doubled down last month, forecasting that “a contraction of economic activity” will begin in Q2 and lead to a mild ...

PKS Investment Advisors LLC

Salisbury • Ocean City • Lewes

Contact

1-800-274-2564

pksinvestmentadvisors@pkscpa.comSubscribe to Newsletter